Understanding Municipal Taxes and Property Assessments

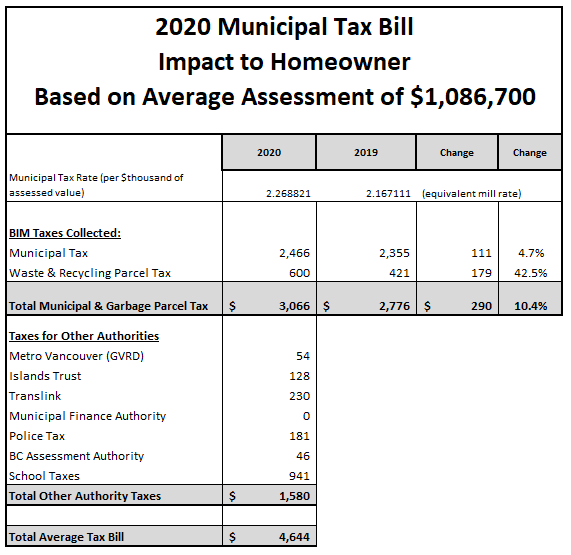

In 2020, BC Assessment reported an average decrease of 5% for most properties on Bowen Island. There are 1,895 single family dwellings on Bowen, at a calculated average value of $1,086,700.

How your taxes are calculated

Municipal Property taxes are calculated by dividing the assessment value for your property by 1,000 and multiplying that figure by the tax rate established for your property class.

There are a number of factors that affect your property taxes on a particular property:

- Changes in assessed value

- Changes in the Municipality's property tax rate

- Changes in other taxing authorities' tax rate

Amounts collected for other taxation authorities

In addition to collecting municipal taxes, BIM is required by legislation to collect funds on behalf of other taxing authorities such as TransLink, Islands Trust, Metro Vancouver, BC Assessment, Municipal Finance Authority (MFA), Provincial School and Police Taxes. The Municipality has no control over the amounts levied as the agencies determine their own rates based on their own budgetary requirements.

Additional School Tax on High-Valued Properties

Starting in 2019, an additional school tax applies to most high-valued residential properties in the province, including:

- Detached homes

- Stratified condominium or townhouse units

- Most vacant land

The additional school tax does not apply to non-stratified rental buildings with four or more housing units.

For mixed-use properties, only the residential portion of the property’s assessed value above $3 million will be taxable.

The additional tax rate is:

- 0.2% on the residential portion assessed between $3 million and $4 million

- 0.4% tax rate on the residential portion assessed over $4 million

BC Assessment determines if additional school tax applies. If you believe your property should be exempt from additional school tax, contact BC Assessment to discuss your concerns.

Why did your taxes go up more than the approved property tax increase?

If the changes in your property value are higher than the average change in your property class your taxes payable may be higher than the approved property tax increase of 4.7%. Similarly, if the changes to your property value are lower relative to the average change in your class, you may see a reduction in your taxes payable.

How your property is assessed

BC Assessment is an independent provincial crown corporation that determines the values of all properties in British Columbia. When establishing the market value of a property, BCA considers factors including real estate market, location, size, age and condition of buildings. Your assessment is based on the valuation of your property as of July 1st of the previous year and all owners are mailed their Property Assessment Notice by December 31st of each year.

Relevant links:

Last Updated on 2022-08-24 at 4:08 PM